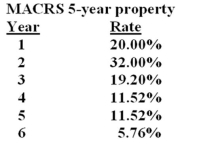

You own some equipment which you purchased three years ago at a cost of $135,000. The equipment is 5-year property for MACRS. You are considering selling the equipment today for $82,500. Which one of the following statements is correct if your tax rate is 34%?

A) The tax due on the sale is $14,830.80.

B) The book value today is $8,478.

C) The book value today is $64,320.

D) The taxable amount on the sale is $38,880.

E) You will receive a tax refund of $13,219.20 as a result of this sale

Correct Answer:

Verified

Q60: Youngers Inc. paid $95,000,in cash,for a piece

Q61: Matty's Place is considering the installation of

Q62: RP&A,Inc. purchased some fixed assets four years

Q63: A project is expected to create operating

Q64: Ronnie's Coffee House is considering a project

Q66: The Wolf's Den Outdoor Gear is considering

Q67: A project will increase sales by $60,000

Q68: A project will increase sales by $140,000

Q69: Winslow,Inc. is considering the purchase of a

Q70: A project will produce operating cash flows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents