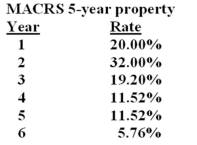

Ronnie's Custom Cars purchased some fixed assets two years ago for $39,000. The assets are classified as 5-year property for MACRS. Ronnie is considering selling these assets now so he can buy some newer fixed assets which utilize the latest in technology. Ronnie has been offered $19,000 for his old assets. What is the net cash flow from the salvage value if the tax rate is 34%?

A) $16,358.88

B) $17,909.09

C) $18,720.00

D) $18,904.80

E) $19,000.00

Correct Answer:

Verified

Q72: Thornley Machines is considering a 3-year project

Q73: LiCheng's Enterprises just purchased some fixed assets

Q74: Tool Makers,Inc. uses tool and die machines

Q75: A project will produce an operating cash

Q76: Bruno's,Inc. is analyzing two machines to determine

Q78: Camille's Café is considering a project which

Q79: Jackson & Sons uses packing machines to

Q80: You just purchased some equipment that is

Q82: Margarite's Enterprises is considering a new project.

Q94: This chapter introduced three new methods for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents