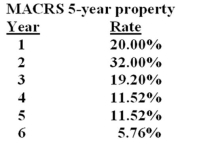

Winslow,Inc. is considering the purchase of a $225,000 piece of equipment. The equipment is classified as 5-year MACRS property. The company expects to sell the equipment after four years at a price of $50,000. What is the after-tax cash flow from this sale if the tax rate is 35%?

A) $37,036

B) $38,880

C) $46,108

D) $47,770

E) $53,892

Correct Answer:

Verified

Q64: Ronnie's Coffee House is considering a project

Q65: You own some equipment which you purchased

Q66: The Wolf's Den Outdoor Gear is considering

Q67: A project will increase sales by $60,000

Q68: A project will increase sales by $140,000

Q70: A project will produce operating cash flows

Q71: Sun Lee's Furniture just purchased some fixed

Q72: Thornley Machines is considering a 3-year project

Q73: LiCheng's Enterprises just purchased some fixed assets

Q74: Tool Makers,Inc. uses tool and die machines

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents