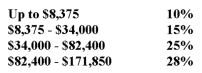

Kim Ye is single and earns $40,000 in taxable income. He uses the following tax rate schedule to calculate the taxes he owes. Calculate the dollar amount of estimated taxes that Kim owes.

A) $6,000.00

B) $6,181.25

C) $10,000.00

D) $11,200.25

E) $16,181.25

Correct Answer:

Verified

Q49: A short-term capital gain is profit earned

Q52: Which one of the following is most

Q70: Mr.and Mrs.Keating want to give their son

Q73: Randal Ice is 57 years old, and

Q74: John Camey goes into a local department

Q75: Drew Davis earns $4,500 per month from

Q79: Which one of these statements correctly applies

Q81: Which one of the following is a

Q81: Two types of education savings plans are

Q85: Thomas Franklin claimed an additional $3,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents