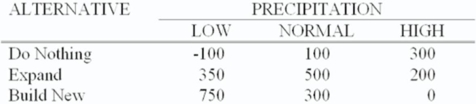

The operations manager for a well-drilling company must recommend whether to build a new facility,expand his existing one,or do nothing.He estimates that long-run profits (in $000) will vary with the amount of precipitation (rainfall) as follows:  If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

If he feels the chances of low,normal,and high precipitation are 30%,20%,and 50%,respectively,what are expected long-run profits for the alternative he will select?

A) $140,000

B) $170,000

C) $285,000

D) $305,000

E) $475,000

Correct Answer:

Verified

Q34: The owner of Tastee Cookies needs to

Q35: The owner of Tastee Cookies needs to

Q36: A former politician,who is now the owner

Q37: The construction manager for Acme Construction,Inc.must decide

Q38: The construction manager for Acme Construction,Inc.must decide

Q40: The owner of Tastee Cookies needs to

Q43: The advertising manager for Roadside Restaurants,Inc.needs to

Q54: One local hospital has just enough space

Q65: Two professors at a nearby university want

Q113: The head of operations for a movie

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents