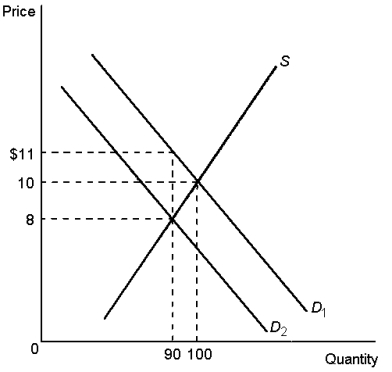

Graph 6-11

-Using Graph 6-11, answer the following questions.

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

f. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Correct Answer:

Verified

b. $3

c. $1

d. $2

e. $1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q125: What are common arguments offered for and

Q126: Graph 6-10 Q129: To what does the term tax incidence Q129: Most labour economists believe that the supply Q132: Using a demand-supply diagram, show how OPEC's Q134: Some countries in the developing world use Q134: A coffee-producing country requires all its growers Q136: If prices are prevented from rationing a Q137: If the demand for coffee and the Q140: Payroll taxes are paid by employers therefore:

![]()

A)the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents