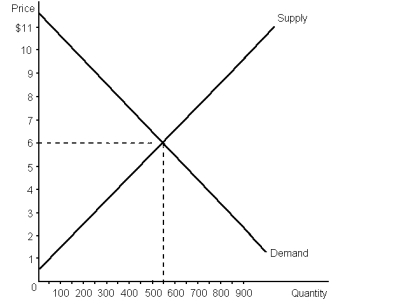

Using the graph below for cases of microwave popcorn, calculate:

a. equilibrium price.

b. equilibrium quantity.

c. consumer surplus.

d. producer surplus.

Now suppose that the government imposes a fat tax $2 tax per case on the sellers of microwave popcorn. Show this on the graph and calculate each of the following after the tax is imposed:

Now suppose that the government imposes a fat tax $2 tax per case on the sellers of microwave popcorn. Show this on the graph and calculate each of the following after the tax is imposed:

e. price paid by buyers

f. price received by sellers

g. consumer surplus

h. producer surplus

i. government revenue

j. deadweight loss

Correct Answer:

Verified

b. 550

c. $151...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: How is the deadweight loss of a

Q123: Suppose Australia puts the same tax on

Q124: Economists disagree on the issue of how

Q128: According to the Laffer curve, what will

Q131: Suppose that instead of a supply-demand diagram,

Q134: Suppose that a tax is imposed on

Q135: A major political problem with collecting taxes

Q136: Using the graph below, determine each of

Q140: What happens to the trade revenue when

Q141: Draw a supply-demand diagram for chocolate. On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents