Your corporation has the following cash flows:

Operating income:$250,000

Interest received:10,000

Interest paid:45,000

Dividends received:20,000

Dividends paid:50,000

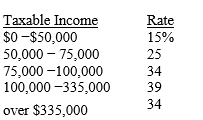

If 70 percent of dividends received are excludable,and if the applicable tax table is as follows, What is the corporation's tax liability?

What is the corporation's tax liability?

A) $57,530

B) $65,350

C) $69,440

D) $88,350

E) $100,280

Correct Answer:

Verified

Q24: _ decisions are decisions about how much

Q25: As a corporate investor paying a marginal

Q26: A corporation with a marginal tax rate

Q27: Your corporation has the following cash flows:

Operating

Q28: In 2014,Craig and Kathy Koehler owned a

Q30: Which of the following is not a

Q31: Which of the following statements is correct?

A)

Q32: A 9 percent coupon bond issued by

Q33: Solarcell Corporation has $20,000 which it plans

Q34: The corporate charter of a firm includes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents