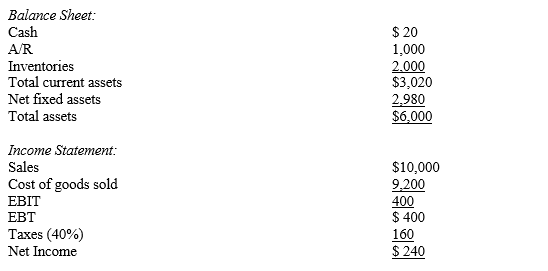

Collins Company had the following partial balance sheet and complete income statement information for 2010:  The industry average DSO is 30 (360-day basis) .Collins plans to change its credit policy so as to cause its DSO to equal the industry average,and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate) ,what will Collins' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the balance sheet?

The industry average DSO is 30 (360-day basis) .Collins plans to change its credit policy so as to cause its DSO to equal the industry average,and this change is expected to have no effect on either sales or cost of goods sold.If the cash generated from reducing receivables is used to retire debt (which was outstanding all last year and which has a 10% interest rate) ,what will Collins' debt ratio (Total debt/Total assets) be after the change in DSO is reflected in the balance sheet?

A) 33.33%

B) 45.28%

C) 52.75%

D) 60.00%

E) 65.71%

Correct Answer:

Verified

Q22: Pepsi Corporation's current ratio is 0.5, while

Q28: If Boyd Corporation has sales of $2

Q29: A firm has total interest charges of

Q30: Borg Security Systems is considering the sale

Q33: As a short-term creditor concerned with a

Q34: Velcraft Company has 20,000,000 shares of common

Q36: Lone Star Plastics has the following data:

Q37: The Charleston Company is a relatively small,privately

Q61: Culver Inc. has earnings after interest but

Q66: You are given the following information: Stockholders'

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents