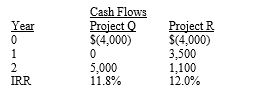

Tara is evaluating two mutually exclusive capital budgeting projects that have the following characteristics:  If the firm's required rate of return (r) is 10 percent,which project should be purchased?

If the firm's required rate of return (r) is 10 percent,which project should be purchased?

A) Both projects should be purchased,because the IRRs for both projects exceed the firm's required rate of return.

B) Neither project should be accepted,because the IRRs for both projects exceed the firm's required rate of return.

C) Project Q should be accepted,because its net present value (NPV) is higher than Project R's NPV.

D) Project R should be accepted,because its net present value (NPV) is higher than Project Q's NPV.

E) None of the above is a correct answer.

Correct Answer:

Verified

Q77: A bank pays a quoted annual (simple)interest

Q78: Your company must make payments of $100,000

Q79: Your lease calls for payments of $500

Q80: Assume that you inherited some money.A friend

Q81: The advantage of the payback period over

Q83: You will receive a $100 annual perpetuity,the

Q84: Two firms evaluated the same capital budgeting

Q85: Hillary is trying to determine the cost

Q86: Discounted payback's primary advantage over traditional payback

Q87: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents