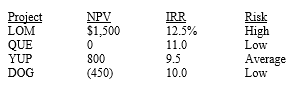

A college intern working at Anderson Paints evaluated potential investments⎯that is,capital budgeting projects⎯using the firm's average required rate of return (WACC) ,and he produced the following report for the capital budgeting manager:  The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

The capital budgeting manager usually considers the risks associated with capital budgeting projects before making her final decision.If a project has a risk that is different from average,she adjusts the average required rate of return by adding or subtracting 2 percentage points.If the four projected listed above are independent,which one(s) should the capital budgeting manager recommend be purchased?

A) Project LOM only,because it has both the highest NPV and the higher IRR.

B) Projects LOM,QUE,and YUP,because they all have positive NPVs and their IRRs.

C) Projects DOG and QUE,because their IRRs are greater than their risk-adjusted discount he projects returns are higher than the rates of return that capital budgeting manager uses to evaluate them.

D) Projects QUE,YUP,and DOG,because their IRRs are greater than their risk-adjusted discount rates-that is,the projects returns are higher than the rates of return that capital budgeting manager uses to evaluate them.

E) There is not enough information to answer this question,because the firm's average required rate of return cannot be determined.

Correct Answer:

Verified

Q90: You have some money on deposit in

Q91: The importance of capital budgeting decisions is

Q92: The _ involves comparing the actual results

Q93: Net present value is preferred to internal

Q94: Benefits of the post-audit include all of

Q96: Union Atlantic Corporation,which has a required rate

Q97: Which of the following statements concerning the

Q98: All of the following factors can complicate

Q99: When Richard evaluated a capital budgeting project⎯a

Q100: What were the ratios of workers paying

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents