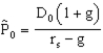

If the model below is to give a "reasonable" valuation of a stock,which of the following is not a valid assumption for the model?

A) Growth,g,is negative.

B) There will be no growth,i.e. ,g is zero.

C) The growth rate exceeds the required rate of return.

D) The required return is exceptionally high (rs > 30%) .

E) All of the above are workable assumptions and are valid in the sense that the model can be used even if they hold true.

Correct Answer:

Verified

Q1: Which of the following statements is most

Q4: Which of the following statements is correct?

A)

Q5: Which of the following statements is correct?

A)

Q6: Which of the following statements is correct?

A)

Q7: Assuming g will remain constant,the dividend yield

Q8: Which of the following statements is correct?

A)

Q10: Suppose a stock is not currently paying

Q11: One of the basic relationships in interest

Q24: An increase in a firm's expected growth

Q28: If the expected rate of return on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents