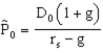

The common stock valuation model,as shown below,gives no consideration to expected capital gains.

Correct Answer:

Verified

Q8: According to the textbook model, under conditions

Q111: All else equal,a higher coupon rate on

Q113: A discount bond is a bond that

Q114: The prices of outstanding bonds are typically

Q115: If two bonds have the same maturity

Q117: You have just noticed in the financial

Q118: All else equal,higher expected cash flows associated

Q119: Regardless of what interest rates do in

Q120: All else equal,a higher required rate of

Q121: Ignoring default risk,since the coupon payments and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents