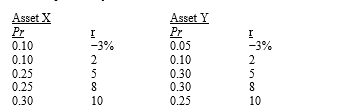

Assume that a new law is passed which restricts investors to holding only one asset.A risk-averse investor is considering two possible assets as the asset to be held in isolation.The assets' possible returns and related probabilities (i.e. ,the probability distributions) are as follows:  Which asset should be preferred?

Which asset should be preferred?

A) Asset X,since its expected return is higher.

B) Asset Y,since its beta is probably lower.

C) Either one,since the expected returns are the same.

D) Asset X,since its standard deviation is lower.

E) Asset Y,since its coefficient of variation is lower and its expected return is higher.

Correct Answer:

Verified

Q47: You hold a diversified portfolio consisting of

Q48: Carlson Products,a constant growth company,has a current

Q49: The probability distribution for rM for the

Q50: Calculate the standard deviation of the expected

Q51: Motor Homes Inc.(MHI)is presently in a stage

Q53: You are managing a portfolio of 10

Q54: Oakdale Furniture Inc.has a beta coefficient of

Q55: As financial manager of Material Supplies Inc.

Q57: Philadelphia Corporation's stock recently paid a dividend

Q80: Berg Inc. has just paid a dividend

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents