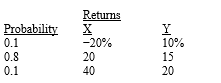

Here are the expected returns on two stocks:  If you form a 50−50 portfolio of the two stocks,what is the portfolio's standard deviation?

If you form a 50−50 portfolio of the two stocks,what is the portfolio's standard deviation?

A) 8.1%

B) 10.5%

C) 13.4%

D) 16.5%

E) 20.0%

Correct Answer:

Verified

Q3: Businesses earn returns for security holders by

Q9: If investors become more averse to risk,

Q17: A firm cannot change its beta through

Q66: When combining many assets into a portfolio

Q69: The biggest reduction in risk would be

Q72: Assume Stock A has a standard deviation

Q73: When considering stock and bond valuation models,we

Q74: Risk averse investors require _ rates of

Q75: Market risk refers to the tendency of

Q76: _ is the appropriate measure for stand-alone

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents