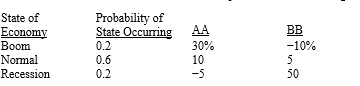

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational risk-averse investor will add Security AA to a well-diversified portfolio over Security BB.

We can conclude from the above information that any rational risk-averse investor will add Security AA to a well-diversified portfolio over Security BB.

Correct Answer:

Verified

Q26: While the portfolio return is a weighted

Q39: If I know for sure that the

Q92: Because the market return represents the return

Q93: All else equal,a risk averse investor choosing

Q95: Risk in financial assets only occurs when

Q96: The risk and return characteristics of an

Q98: When comparing two different stocks with the

Q99: It is possible that the actual return

Q101: The coefficient of variation is useful in

Q102: The correlation coefficient is a measure of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents