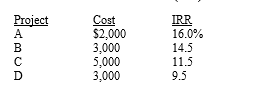

Anderson Company has four investment opportunities with the following costs (all costs are paid at t = 0) and estimated internal rates of return (IRR) :  The company has a target capital structure that consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share (i.e. ,

The company has a target capital structure that consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share (i.e. ,  = $3.00) .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

= $3.00) .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

A) 7.75%

B) 8.90%

C) 10.46%

D) 11.54%

E) 12.68%

Correct Answer:

Verified

Q34: Gulf Electric Company (GEC)

Gulf Electric Company (GEC)

Q35: Which of the following statements is correct?

A)

Q36: Global Advertising Company

The Global Advertising Company had

Q37: Global Advertising Company

The Global Advertising Company had

Q38: Global Advertising Company

The Global Advertising Company had

Q40: Allison Engines Corporation has established a target

Q41: Rollins Corporation

Rollins Corporation is constructing its MCC

Q42: Becker Glass Corporation

Becker Glass Corporation expects to

Q43: Byron Corporation

Byron Corporation's present capital structure, which

Q44: Rollins Corporation

Rollins Corporation is constructing its MCC

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents