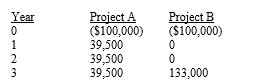

Two projects being considered by a firm are mutually exclusive and have the following projected cash flows:  Based only on the information given,which of the two projects would be preferred,and why?

Based only on the information given,which of the two projects would be preferred,and why?

A) Project A,because it has a shorter payback period.

B) Project B,because it has a higher IRR.

C) Indifferent,because the projects have equal IRRs.

D) Include both in the capital budget,since the sum of the cash inflows exceeds the initial investment in both cases.

E) Choose neither,since their NPVs are negative.

Correct Answer:

Verified

Q68: Virus Stopper Inc. ,a supplier of computer

Q69: Sun State Mining Inc. ,an all-equity firm,is

Q71: Klott Company encounters significant uncertainty with its

Q72: Arizona Rock,an all-equity firm,currently has a beta

Q72: Scott Corporation's new project calls for an

Q74: Two fellow financial analysts are evaluating a

Q74: California Mining is evaluating the introduction of

Q75: Mom's Cookies Inc.is considering the purchase of

Q77: An all-equity firm is analyzing a potential

Q78: The Unlimited, a national retailing chain, is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents