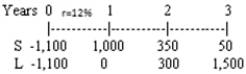

A company is analyzing two mutually exclusive projects,S and L,whose cash flows are shown below:  The company's required rate of return is 12 percent,and it can get an unlimited amount of funds at that rate.What is the IRR of the better project,i.e. ,the project which the company should choose if it wants to maximize the price of its stock?

The company's required rate of return is 12 percent,and it can get an unlimited amount of funds at that rate.What is the IRR of the better project,i.e. ,the project which the company should choose if it wants to maximize the price of its stock?

A) 12.00%

B) 15.53%

C) 18.62%

D) 19.08%

E) 20.46%

Correct Answer:

Verified

Q72: Scott Corporation's new project calls for an

Q74: California Mining is evaluating the introduction of

Q77: An all-equity firm is analyzing a potential

Q79: Mars Inc.is considering the purchase of a

Q80: Assume you are the director of capital

Q82: Your company is considering a machine which

Q83: Your company is considering a machine that

Q84: A company is analyzing two mutually exclusive

Q85: Woodson Inc.has two possible projects,Project A and

Q86: Truck Acquisition

You have been asked by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents