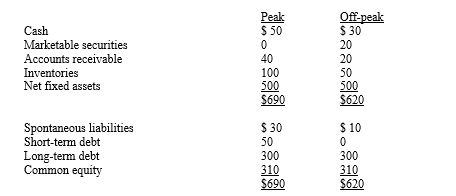

Ski Lifts Inc.is a highly seasonal business.The following summary balance sheet provides data for peak and off-peak seasons (in thousands of dollars) :  From this data,we may conclude that

From this data,we may conclude that

A) Ski Lifts has a working capital financing policy of exactly matching asset and liability maturities.

B) Ski Lifts' working capital financing policy is relatively aggressive;that is,the company finances some of its permanent assets with short-term discretionary debt.

C) Ski Lifts follows a relatively conservative approach to working capital financing;that is,some of its short-term needs are met by permanent capital.

D) Without income statement data,we cannot determine the aggressiveness or conservatism of the company's working capital policy.

E) Both a and c are correct.

Correct Answer:

Verified

Q2: Which of the following statements is most

Q3: Which of the following statements is correct?

A)

Q4: Which of the following investments is not

Q5: In the text,the "red-line method" refers to

A)

Q6: Which of the following might be attributed

Q8: Working capital policy involves

A) The level of

Q9: Analyzing days sales outstanding (DSO)and the aging

Q10: Which of the following statements is correct?

A)

Q11: Firms generally choose to finance temporary assets

Q12: Which of the following statements is correct?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents