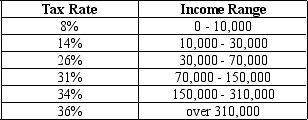

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If John has taxable income of $72,000,his average tax rate is

A) 20.3%.

B) 20.9%.

C) 21.4%.

D) 22.2%.

Correct Answer:

Verified

Q129: The public welfare spending category for state

Q132: Among the major spending categories for state

Q172: Rank the following state and local government

Q177: Table 12-2

Consider the tax rates shown in

Q181: Adam,Barb,and Carli each like to read novels.The

Q281: A tax system with little deadweight loss

Q286: In addition to tax payments, the two

Q295: The resources that a taxpayer devotes to

Q492: Suppose a country imposes a lump-sum income

Q496: Suppose a country imposes a lump-sum income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents