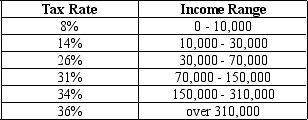

Table 12-2

Consider the tax rates shown in the table below.

-Refer to Table 12-2.If Max has taxable income of $227,000,his average tax rate is

A) 15.7%.

B) 26.8%.

C) 27.8%.

D) 28.6%.

Correct Answer:

Verified

Q51: Medicare is the

A)government's health plan for the

Q61: The most common explanation for Social Security

Q61: Which of the following is not true

Q65: All of the following are transfer payments

Q106: The largest category of federal government spending

Q130: State and local government spending on public

Q162: Table 12-2

Consider the tax rates shown in

Q163: Table 12-2

Consider the tax rates shown in

Q164: Table 12-2

Consider the tax rates shown in

Q174: Individual Retirement Accounts and 401(k) plans make

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents