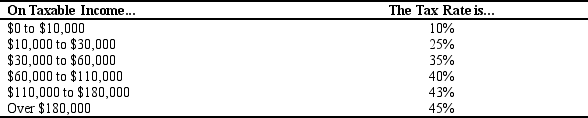

Table 12-9

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-9.For this tax schedule,what is the total tax liability for an individual with $280,000 in taxable income?

A) $105,700

B) $108,900

C) $111,600

D) $117,300

Correct Answer:

Verified

Q280: Table 12-6 Q281: Table 12-8 Q283: Table 12-9 Q284: If a government simplified its tax system Q289: Table 12-9 Q290: Table 12-10 Q482: Lump-sum taxes are rarely used in the Q492: Suppose a country imposes a lump-sum income Q494: Suppose a country imposes a lump-sum income Q496: Suppose a country imposes a lump-sum income

![]()

![]()

The table below shows the marginal

The table below shows the marginal

The following table shows the marginal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents