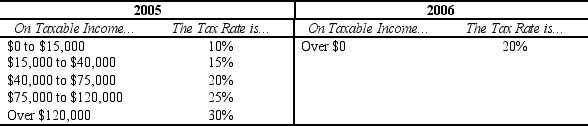

Table 12-10

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-10.For an individual who earned $35,000 in taxable income in both years,which of the following describes the change in the individual's marginal tax rate between the two years?

A) The marginal tax rate increased from 2005 to 2006.

B) The marginal tax rate decreased from 2005 to 2006.

C) The marginal tax rate remained constant from 2005 to 2006.

D) The change in the marginal tax rate cannot be determined for the two tax schedules shown.

Correct Answer:

Verified

Q294: Table 12-9

The table below shows the marginal

Q315: Table 12-10

The following table shows the marginal

Q318: Table 12-12

United States Income Tax Rates for

Q321: Table 12-14

The following table presents the total

Q322: Table 12-12

United States Income Tax Rates for

Q323: Table 12-12

United States Income Tax Rates for

Q324: Table 12-12

United States Income Tax Rates for

Q325: Table 12-15

The dollar amounts in the last

Q482: Lump-sum taxes are rarely used in the

Q498: One advantage of a lump-sum tax over

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents