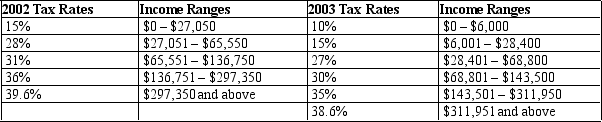

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Charles is a single person whose taxable income is $35,000 a year.What is his marginal tax rate in 2002?

A) 15%

B) 28%

C) 31%

D) 36%

Correct Answer:

Verified

Q102: Vertical equity and horizontal equity are associated

Q204: The concept that people should pay taxes

Q333: Table 12-15

The dollar amounts in the last

Q334: Table 12-14

The following table presents the total

Q335: Table 12-13

The following table shows the marginal

Q336: Table 12-12

United States Income Tax Rates for

Q337: Table 12-13

The following table shows the marginal

Q339: Table 12-12

United States Income Tax Rates for

Q340: Table 12-15

The dollar amounts in the last

Q341: Table 12-16

United States Income Tax Rates for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents