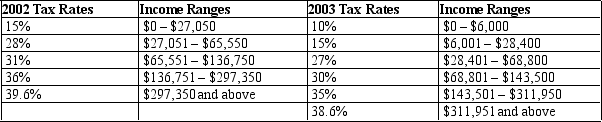

Table 12-12

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-12.Samantha is a single person whose taxable income is $100,000 a year.What happened to her marginal tax rate between 2002 and 2003?

A) It increased.

B) It decreased.

C) It did not change.

D) We do not have enough information to answer this question.

Correct Answer:

Verified

Q219: The notion that similar taxpayers should pay

Q327: Table 12-12

United States Income Tax Rates for

Q329: Table 12-14

The following table presents the total

Q330: Table 12-14

The following table presents the total

Q331: Table 12-12

United States Income Tax Rates for

Q333: Table 12-15

The dollar amounts in the last

Q334: Table 12-14

The following table presents the total

Q335: Table 12-13

The following table shows the marginal

Q336: Table 12-12

United States Income Tax Rates for

Q337: Table 12-13

The following table shows the marginal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents