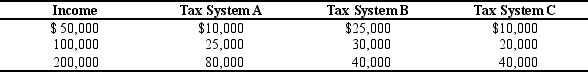

Table 12-15

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-A lump-sum tax

A) is also a proportional tax.

B) entails larger deadweight losses than other types of taxes.

C) is the most efficient tax possible.

D) is the most equitable tax possible.

Correct Answer:

Verified

Q81: "A $1,000 tax paid by a poor

Q89: The benefits principle of taxation can be

Q93: Suppose an excise tax is imposed on

Q95: When a tax is justified on the

Q106: In the 1980s, President Ronald Reagan argued

Q115: Vertical equity in taxation refers to the

Q116: Vertical equity states that taxpayers with a

Q122: If a tax takes a smaller fraction

Q208: The argument that each person should pay

Q212: If revenue from a gasoline tax is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents