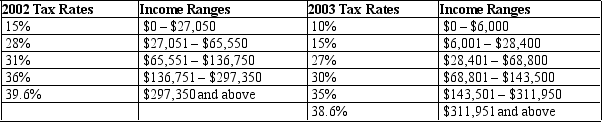

Table 12-16

United States Income Tax Rates for a Single Individual,2002 and 2003.

-Refer to Table 12-16.What type of tax structure does the United States have in 2003 for single individuals?

A) A proportional tax structure

B) A regressive tax structure

C) A progressive tax structure

D) A lump-sum tax structure

Correct Answer:

Verified

Q90: The principle that people should pay taxes

Q94: The theory that the wealthy should contribute

Q95: When a tax is justified on the

Q102: Vertical equity and horizontal equity are associated

Q104: The claim that all citizens should make

Q204: The concept that people should pay taxes

Q205: A tax system based on the ability-to-pay

Q212: If revenue from a gasoline tax is

Q214: If a poor family has three children

Q346: The benefits principle is used to justify

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents