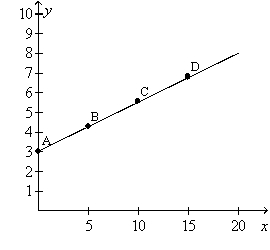

Figure 27-2.On the graph,x represents risk and y represents return.

-Robert is risk averse and has $1,000 with which to make a financial investment.He has three options.Option A is a risk-free government bond that pays 5 percent interest each year for two years.Option B is a low-risk stock that analysts expect to be worth about $1,102.50 in two years.Option C is a high-risk stock that is expected to be worth about $1,200 in four years.Robert should choose

A) option A.

B) option B.

C) option C.

D) either A or B because they are the same to him.

Correct Answer:

Verified

Q4: Figure 27-1.The figure shows a utility function.

Q5: Figure 27-1.The figure shows a utility function.

Q33: A measure of the volatility of a

Q39: Diversification of a portfolio

A)can eliminate market risk,but

Q54: Which of the following defines an annuity?

A)For

Q59: A risk-averse person has

A)utility and marginal utility

Q60: Which of the following is correct concerning

Q80: When you rent a car,you might treat

Q236: If Julieanne is risk-averse,then she will always

A)

Q244: Sally buys health insurance because she knows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents