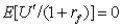

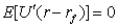

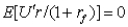

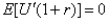

The condition for optimal portfolio choice can be represented by:

A)

B)

C)

D)

Correct Answer:

Verified

Q9: A risk-neutral individual is offered a gamble

Q10: Risk-averse individuals will diversify their investments because

Q11: The formula for the Pratt measure of

Q12: Risk aversion is best explained by:

A)timidness.

B)increasing marginal

Q13: The expected value of a random variable

Q14: Which of the following utility functions exhibits

Q16: Which of the following utility functions exhibits

Q17: More risk-averse people will:

A)hold fewer risky assets

Q18: What property of the von-Neumann Morgenstern utility

Q19: Faced with an uncertain situation,the best decision

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents