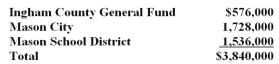

Ingham County collects,in addition to its own taxes,taxes for other units.Tax levied for 2014 were as follows:

Collections from the 2014 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.

Collections from the 2014 levies amounted to $3,550,000 and were distributed in proportion to the original levies,less a 1% collection fee charged Mason City and the Mason School District.Collection fees are remitted to the Ingham County General Fund.

Required

1)Record the tax levies in the Ingham County Tax Agency Fund.

2)Record the collection from the 2014 tax levies in the Ingham County Tax Agency Fund and the specific liabilities owed each fund and unit (Round all amounts to the nearest whole dollar.)

3)Record in the Ingham County Tax Agency Fund the transfer of collected taxes to each fund and unit.

Correct Answer:

Verified

Q42: A local golfer contributed $100,000 to the

Q43: Employer contributions to a public employee retirement

Q44: Kirby County established a tax agency fund

Q45: Explain the difference between an internal cash

Q45: Which of the following is the appropriate

Q47: In financial reporting for proprietary funds and

Q49: Fiduciary funds are accounted for in a

Q50: If a city has a fiduciary responsibility

Q51: Which of the following activities would be

Q52: Which of the following is the appropriate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents