Compute the legal debt margin for Mountain City given the following information regarding its bonded debt.

1)The legal debt limit is 10 percent of total assessed valuation.

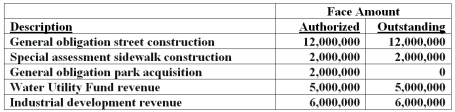

2)Bonds outstanding and bonds authorized are:

Note: The city has no general obligation liability for the revenue bonds or the industrial development bonds.

Note: The city has no general obligation liability for the revenue bonds or the industrial development bonds.

3)Total assessed valuation of property within Mountain City is $200,000,000.

Correct Answer:

Verified

Q62: "The entire debt arising from the acquisition

Q71: As of the fiscal year ending September

Q72: "Bonds to be retired by a debt

Q73: The following key terms from Chapter 6

Q74: In the current fiscal year,Casper County issued

Q75: The General Fund of the city of

Q78: The sale of revenue bonds by a

Q79: Explain the financial reporting for special assessment

Q80: Explain the essential differences between regular serial

Q81: From records available in various offices of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents