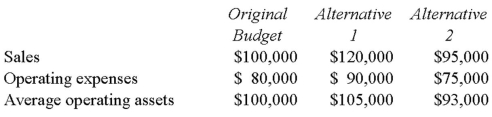

Stephanie Co.'s managers are considering alternative strategies to improve ROI from its current budgeted 20% for the coming year.Alternative 1 has more money spent on advertising to increase sales while alternative 2 has the budget for meals and entertainment expenses eliminated with a drop off in sales as a result.Adjustments to operating assets are anticipated in each of the two alternatives as well.The numbers as in the original budget and in the two alternatives are set out below:  What is the relative ranking based upon ROI of the above three choices (highest to lowest) ?

What is the relative ranking based upon ROI of the above three choices (highest to lowest) ?

A) Original Budget,Alternative 1,Alternative 2.

B) Alternative 1,Alternative 2,Original Budget.

C) Alternative 2,Original Budget,Alternative 1.

D) Original Budget,Alternative 2,Alternative 1.

Correct Answer:

Verified

Q43: Sales and average operating assets for Company

Q45: If the South Division wants a residual

Q46: Last year,a company had stockholder's equity of

Q47: If the Axle Division sells 16,000 units

Q49: Division A's sales are?

A) $125,000.

B) $200,000.

C) $400,000.

D)

Q50: Estes Company has assembled the following data

Q50: Reed Company's sales last year totalled $150,000

Q51: Howe Company increased its ROI from 20%

Q52: Largo Company recorded for the past year,sales

Q53: The Northern Division of the Smith Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents