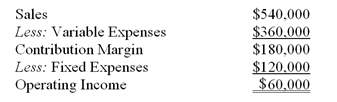

Belli-Pitt,Inc produces a single product.The results of the company's operations for a typical month are summarized in contribution format as follows:

Required:

a) Given the present situation, compute

1 The break-even sales in kilograms.

2 The break-even sales in dollars.

3 The sales in kilograms that would be required to produce operating income of $90,000.

4 The margin of safety in dollars.

b) An important part of processing is performed by a machine that is currently being leased for $20,000 per month. Belli-Pitt has been offered an arrangement whereby it would pay $0.10 royalty per kilogram processed by the machine rather than the monthly lease.

1 Should the company choose the lease or the royalty plan?

2 Under the royalty plan, compute the break-even point in kilograms.

3 Under the royalty plan, compute the break-even point in dollars.

4 Under the royalty plan, determine the sales in kilograms that would be required to produce operating income of $90,000.

Correct Answer:

Verified

1. Sales = Variable expenses + Fixed...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: The following monthly budgeted data is available

Q132: The basic cost-volume-profit model assumes no change

Q132: Kilimanjaro Company (KC)makes and sells one product:

Q133: The following monthly budgeted data are available

Q134: The following monthly data are available for

Q136: The Deli City Sandwich Shop tries to

Q138: Seco Corp.,a wholesale supply company,uses independent sales

Q139: Sales = Variable expenses + Fixed expenses

Q140: Tanner Company's most recent contribution format income

Q141: Jeff Merchandisers (JM)has determined with 100 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents