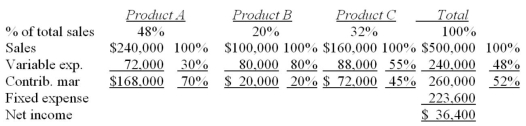

Barnes Company sells three products-A,B,andC.Budgeted sales by product and in total for the coming month are as follows:

Break-even sales-Budgeted: Fixed Expenses = $223,600 = $430,000

Break-even sales-Budgeted: Fixed Expenses = $223,600 = $430,000

CM Ratio 0.52

As shown by these data,net income is budgeted at $36,400 for the month,and break-even sales at $430,000.

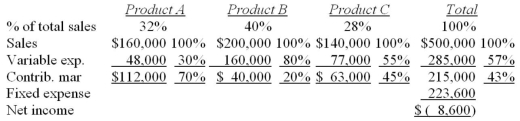

Assume that actual sales for the month total $500,000 as planned.Actual sales by product are: A,$160,000;B,$200,000;and C,$140,000.

Required:

a.Prepare a contribution income statement for the month based on actual sales data.Assume variable expenses as a percentage of sales and total fixed expenses are the same as budgeted.Present the income statement in the format shown above.

b.Compute break-even sales for the month,based on actual data.

c.Explain why the company did not meet the budgeted operating results or break-even sales even though it met its $500,000 sales budget.

a.

b.Break-even sales:

b.Break-even sales:

Fixed Expenses = $223,600 = $520,000

CM Ratio 0.43

c.Despite the fact that the Company met its sales budget of $500,000 for the month,the mix of products sold changed from that budgeted.This is the reason the budgeted net income was not met,and the reason the break-even sales were greater than budgeted.The company's sales mix was planned at 48% A,20% B,and 32%C.The actual sales mix was 32% A,40% B,and only 28%C.The budgeted contribution margin was 52%,while the actual contribution margin was 43%.This also explains why the break-even point was higher than planned.With less average contribution margin per dollar of sales,a greater level of sales is required to provide sufficient contribution margin to cover fixed costs.

Correct Answer:

Verified

Break-even sales-Budgeted:Fixed Expens...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q130: The following is Alsatia Corporation's contribution format

Q131: The following monthly budgeted data is available

Q138: The break-even point in annual sales dollars

Q140: A sales manager has projected that an

Q141: Oates Tannery sells boxes of leather for

Q142: Jimbob Co.is a manufacturing company with the

Q144: Given the above data,how many families can

Q145: At the end of its fifth year

Q146: A training and development organization has fixed

Q147: The Board of Directors of Ryan Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents