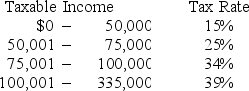

Given the tax rates as shown,what is the average tax rate for a firm with taxable income of $228,610?

A) 36.38%

B) 33.88%

C) 31.67%

D) 34.64%

E) 39.00%

Correct Answer:

Verified

Q49: A change in which one of these

Q52: Brad's Company has equipment with a book

Q54: _ refers to the cash flow resulting

Q55: Lester's has $33,600 in sales,$17,200 in cost

Q56: A firm has $480 in inventory,$1,860 in

Q58: A firm has total equity of $2,011,net

Q58: _ refers to the changes in net

Q60: Martha's Enterprises spent $3,300 to purchase equipment

Q61: School House Antiques has current assets of

Q62: You have compiled the following information on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents