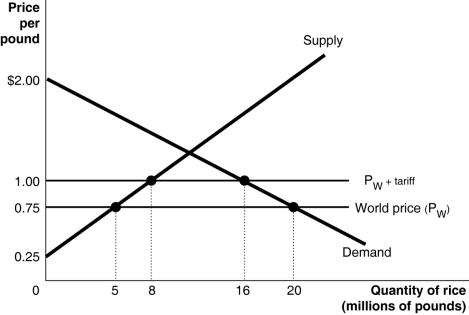

Figure 7-4

-Refer to Figure 7-4.Suppose the U.S.government imposes a $0.25 per pound tariff on rice imports.Figure 9-8 shows the demand and supply curves for rice and the impact of this tariff.Use the figure to answer questions a-i.

a.Following the imposition of the tariff,what is the price that domestic consumers must now pay and what is the quantity purchased?

b.Calculate the value of consumer surplus with the tariff in place.

c.What is the quantity supplied by domestic rice growers with the tariff in place?

d.Calculate the value of producer surplus received by U.S.rice growers with the tariff in place.

e.What is the quantity of rice imported with the tariff in place?

f.What is the amount of tariff revenue collected by the government?

g.The tariff has reduced consumer surplus.Calculate the loss in consumer surplus due to the tariff.

h.What portion of the consumer surplus loss is redistributed to domestic producers? To the government?

i.Calculate the deadweight loss due to the tariff.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q164: Dumping refers to

A)selling inferior products to unsuspecting

Q165: Figure 7-5 Q166: In general,the costs tariffs and quotas impose Q167: Many economists _ protectionism because it _ Q168: One reason for the success that firms Q170: In 1930,the U.S.government attempted to help domestic Q171: Eliminating trade barriers does all of the Q172: Your roommate Hansen argues that American producers Q173: All but one of the following statements Q174: Domestic producers require time to gain experience![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents