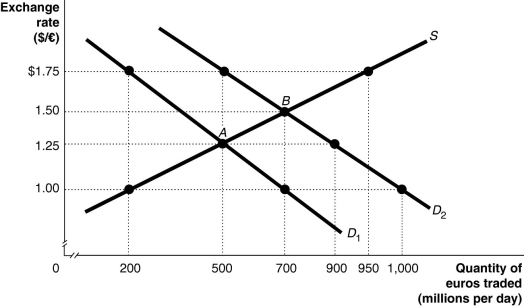

Figure 19-8

-Refer to Figure 19-8.The equilibrium exchange rate is at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.At the pegged exchange rate

A) there is a shortage of euros equal to 500 million.

B) there is a surplus of euros equal to 300 million.

C) there is a shortage of euros equal to 200 million.

D) there is a surplus of euros equal to 700 million.

Correct Answer:

Verified

Q137: If the implied exchange rate between Big

Q138: A Big Mac costs $4.93 in the

Q139: A Big Mac costs $4.93 in the

Q140: If,at the current exchange rate between the

Q141: A currency pegged at a value above

Q143: Figure 19-7 Q144: If a country's currency _ the dollar,its Q145: The Bulgarian currency,the lev,is pegged to the Q146: Compared to a situation in which there Q147: Figure 19-7 ![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents