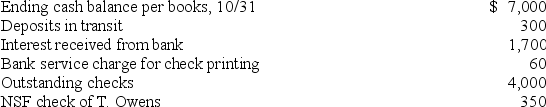

Lenore,Inc.gathered the following information from its accounting records and the October bank statement to prepare the October bank reconciliation:  What journal entry would Lenore,Inc.be required to record for the interest received from the bank?

What journal entry would Lenore,Inc.be required to record for the interest received from the bank?

A) Debit Interest Revenue and credit Cash for $1,700.

B) No journal entry is required because the bank is aware of the interest payment.

C) Debit Interest Receivable and credit Interest Revenue for $1,700.

D) Debit Cash and credit Interest Revenue for $1,700.

Correct Answer:

Verified

Q123: The following information was available to the

Q124: When preparing this month's bank reconciliation,you find

Q125: On October 31,2018,your company's records say that

Q126: Which of the following is added to

Q127: Lenore,Inc.gathered the following information from its accounting

Q129: If the company's accountant mistakenly recorded an

Q130: In comparing the canceled checks on the

Q131: If a bank reconciliation included a deposit

Q132: Which of the following is deducted from

Q133: Which of the following would be deducted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents