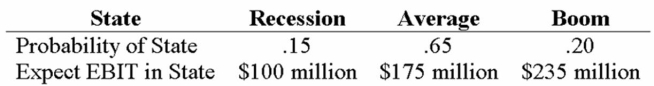

Your company doesn't face any taxes and has $750 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 3.76

B) 9.15

C) 14.17

D) 83.79

Correct Answer:

Verified

Q8: Which of the following is a true

Q16: Which of the following allows for two

Q17: If a firm changes their capital structure

Q18: This is the mix of debt and

Q19: This is the assumption that decisions about

Q22: Your company doesn't face any taxes and

Q23: Suppose that a company's equity is currently

Q25: This is a situation that arises when

Q26: Suppose that a company's equity is currently

Q35: Suppose that a company's equity is currently

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents