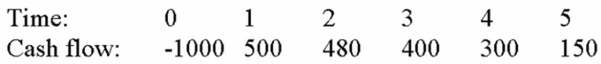

Compute the Discounted Payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is 10 percent and the maximum allowable discounted payback is 3 years.

A) 2.49 years, accept

B) 2.98 years, accept

C) 3.49 years, reject

D) 4.98 years, reject

Correct Answer:

Verified

Q16: Compute the NPV for Project X and

Q18: The Net Present Value decision technique may

Q18: All capital budgeting techniques

A) render the same

Q19: The Net Present Value decision technique uses

Q20: A capital budgeting technique that generates a

Q22: Use the IRR decision rule to evaluate

Q23: Use the MIRR decision rule to evaluate

Q24: Use the payback decision rule to evaluate

Q25: Use the discounted payback decision rule to

Q26: Use the payback decision rule to evaluate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents