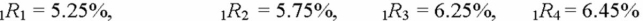

Forecasting Interest Rates On May 23, 20XX, the existing or current (spot) one-year, two-year, three-year, and four-year zero-coupon Treasury security rates were as follows:

Using the unbiased expectations theory, what is the one-year forward rate on zero-coupon Treasury bonds for year four as of May 23, 20XX?

A.5.925%

B.6.45%

C.7.05%

D. 10.32%

Correct Answer:

Verified

4f1 = [(1 + 1R4)4/(1 + 1R3)...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: This is the risk that a security

Q18: Which of these does NOT perform vital

Q19: These provide a forum in which demanders

Q20: Which of the following is NOT a

Q22: Unbiased Expectations Theory One-year Treasury bills currently

Q23: Interest rates A 2-year Treasury security currently

Q24: This is the expected or "implied" rate

Q25: Liquidity Premium Hypothesis The Wall Street Journal

Q26: According to this theory of term structure

Q37: Which of these statements is true?

A)The higher

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents