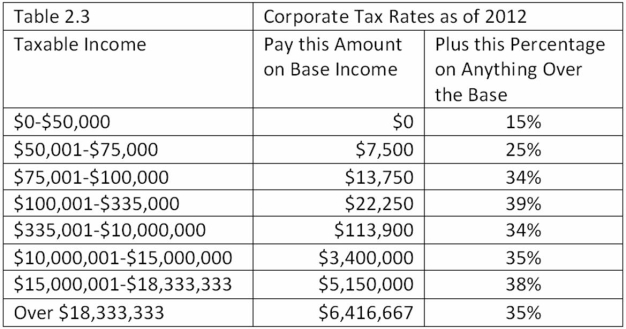

Corporate Taxes Eccentricity, Inc. had $300,000 in 2010 taxable income. Using the tax schedule from Table 2-3, what is the company's 2010 income taxes, average tax rate, and marginal tax rate, respectively?

A) $22,250, 7.42%, 39%

B) $78,000, 26.00%, 39%

C) $100,250, 33.42%, 39%

D) $139,250, 46.42%, 39%

Correct Answer:

Verified

Q22: Statement of Retained Earnings TriCycle, Corp. began

Q26: Free Cash Flow You are considering an

Q28: Statement of Retained Earnings Use the following

Q30: Statement of Cash Flows Paige's Properties Inc.

Q31: Free Cash Flow Catering Corp. reported free

Q32: Statement of Retained Earnings Night Scapes, Corp.

Q50: Balance Sheet Ted's Taco Shop has total

Q51: Balance Sheet Hair Etc.has total assets of

Q57: Market Value versus Book Value Acme Bricks

Q59: Balance Sheet School Books,Inc.has total assets of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents