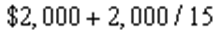

A zero coupon bond is a bond that pays no return until it comes due and then pays the holder of the bond its face value. Suppose that a $2,000 zero coupon bond will come due on January 1, 2020. If the interest rate is 5% and will remain 5% forever, what will this bond be worth on January 1, 2005?

A)

B)

C)

D)

E) None of the above.

Correct Answer:

Verified

Q25: Bank 1 offers a deal on deposits

Q26: The interest rate is 10% and will

Q29: A bond has a face value of

Q31: The sum of the terms of the

Q33: A bond has a face value of

Q34: Shivers's annual fuel bill for home heating

Q35: The price of an antique is expected

Q36: The price of an antique is expected

Q38: The sum of the terms of the

Q39: Shiver's annual fuel bill for home heating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents