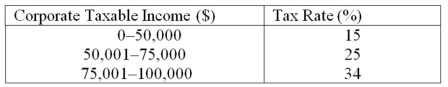

What are the average and marginal tax rates for a corporation that has $97,648 of taxable income? The tax rates are as follows:

A) 21.97%; 25%

B) 21.97%; 34%

C) 23.08%; 34%

D) 34%; 34%

Correct Answer:

Verified

Q103: What is the overall change in cash

Q104: Which type of income is subject to

Q108: Who pays taxes on earnings distributed as

Q109: Why might it be difficult to rely

Q111: Assume tax rates on single individuals are

Q114: Professor Diehard found an effective antibiotic for

Q115: Describe the practice of double taxation of

Q116: Which one of these will increase a

Q117: Why should corporate financial managers be concerned

Q118: Describe the information contained in the balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents