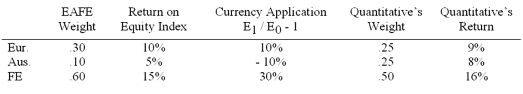

The manager of Quantitative International Fund uses EAFE as a benchmark.Last year's performance for the fund and the benchmark were as follows:  Calculate Quantitative's currency selection return contribution.

Calculate Quantitative's currency selection return contribution.

A) +20%

B) -5%

C) +15%

D) +5%

E) -10%

Correct Answer:

Verified

Q9: Suppose the 1-year risk-free rate of return

Q26: The _ equity market had the highest

Q27: The major concern that has been raised

Q28: In 2011, the U.S.equity market represented _

Q28: Exchange-rate risk

A) results from changes in the

Q32: You are a U.S.investor who purchased British

Q33: International investing

A)cannot be measured against a passive

Q34: The yield on a 1-year bill in

Q35: The interest rate on a 1-year Canadian

Q38: Investors looking for effective international diversification should

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents