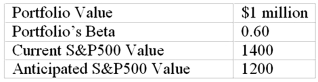

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  If the anticipated market value materializes, what will be your expected loss on the portfolio

If the anticipated market value materializes, what will be your expected loss on the portfolio

A) 14.29%

B) 16.67%

C) 15.43%

D) 8.57%

E) 6.42%

Correct Answer:

Verified

Q29: Which two indices had the highest correlation

Q33: Commodity futures pricing

A)must be related to spot

Q35: Suppose that the risk-free rates in the

Q36: You are given the following information about

Q37: Arbitrage proofs in futures market pricing relationships

A)rely

Q39: Trading in stock index futures

A)now exceeds buying

Q40: A swap

A)obligates two counterparties to exchange cash

Q42: Why are commodity futures prices different from

Q42: If covered interest arbitrage opportunities do not

Q48: A hedge ratio can be computed as

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents