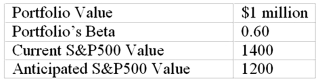

You are given the following information about a portfolio you are to manage.For the long-term you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position Allow fractions of contracts in your answer.

A) sell 1.714

B) buy 1.714

C) sell 4.236

D) buy 4.236

E) sell 11.235

Correct Answer:

Verified

Q6: Suppose that the risk-free rates in the

Q21: If you sold S&P 500 Index futures

Q23: You are given the following information about

Q24: Credit risk in the swap market

A)is extensive.

B)is

Q24: The value of a futures contract for

Q28: Which two indices had the lowest correlation

Q29: Hedging one commodity by using a futures

Q29: If you took a short position in

Q33: In the equation Profits = a +

Q34: One reason swaps are desirable is that

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents