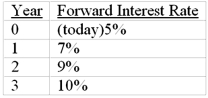

Suppose that all investors expect that interest rates for the 4 years will be as follows:  What is the yield to maturity of a 3-year zero-coupon bond

What is the yield to maturity of a 3-year zero-coupon bond

A) 7.03%

B) 9.00%

C) 6.99%

D) 7.49%

E) None of the options

Correct Answer:

Verified

Q9: The term structure of interest rates is

A)the

Q11: The value of a Treasury bond should

A)be

Q11: According to the expectations hypothesis, an upward-sloping

Q12: If the value of a Treasury bond

Q14: If the value of a Treasury bond

Q15: Which of the following is not proposed

Q16: If the value of a Treasury bond

Q17: An inverted yield curve implies that

A)long-term interest

Q18: An upward sloping yield curve is a(n)

Q19: Treasury STRIPS are

A) securities issued by the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents