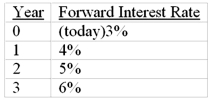

Suppose that all investors expect that interest rates for the 4 years will be as follows:  If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000.)

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same (Par value of the bond = $1,000.)

A) 5%

B) 3%

C) 9%

D) 10%

E) None of the options

Correct Answer:

Verified

Q21: The most recently issued Treasury securities are

Q21: Forward rates _ future short rates because

Q22: Suppose that all investors expect that interest

Q23: Suppose that all investors expect that interest

Q24: Which of the following combinations will result

Q27: The pure yield curve can be estimated

A)

Q27: The "break-even" interest rate for year n

Q31: An inverted yield curve is one

A) with

Q31: The following is a list of prices

Q34: The on the run yield curve is

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents